Spain’s Demographic Growth: A Clear Advantage for Real Estate Investors

What demographic trends reveal about housing demand in key European markets

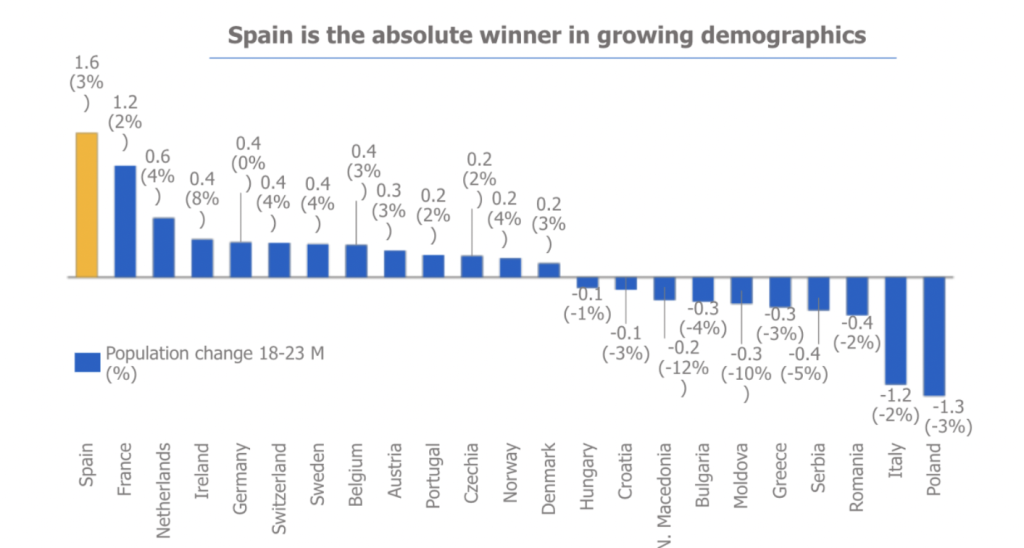

While many European countries are facing population stagnation or decline, Spain continues to move in the opposite direction. Between 2018 and 2023, Spain recorded the largest population growth in the EU—adding 1.6 million residents, according to Eurostat. In contrast, countries like Italy and Poland experienced significant demographic contraction.

This growth isn’t limited to the national level. Madrid, Barcelona, Málaga, Valencia, and Alicante all appear among Europe’s top-performing cities in terms of urban population gains during the same period.

Urban growth is concentrated—and consistent

- Madrid: +300,000 people (+5%)

- Barcelona: +200,000 (+4%)

- Málaga, Valencia, Alicante: +100,000 each, with growth rates between 4–10%

- Cities like Paris, Naples and Bucharest: experienced declines

What’s behind the growth?

- It ranks #2 globally in tourism, according to UNWTO

- It is the 4th largest real estate investment market in the EU (MSCI)

- It is consistently rated a top destination for expats (InterNations)

- Cities like Madrid now rank among the most attractive for real estate investors in Europe

These dynamics contribute to a demographic environment defined not only by growth, but by sustained demand, international attention, and strong urban appeal.

Implications for Strategic Co-Investment in 2025

At Homad, we view demographic resilience as a core indicator of housing demand stability. Spain’s continued growth—both nationally and in specific metro areas—suggests an opportunity to build exposure to residential assets with long-term fundamentals.

We’re especially focused on markets like Madrid, Barcelona and Málaga, where the combination of population growth, investment activity, and quality of life supports a clear investment thesis.